Brand Strategy – November 2008

Dominant in the telecommunications services market, Bharti Enterprises, the telecom giant has unveiled its vision for 2020. Its latest brand identity attempts to reflect its intent to grow its other businesses such as financial services, retail and agri-business.

New Brand Identity and Brand Essence

In early Novemeber (2008), Bharti Enterprises, the Indian business conglomerate with revenues at over Rs. 30,000 crore, unveiled a new brand logo and brand identity. With its new brand identity, Bharti plans to announce its strategic intent to create a conglomerate of the future. The new brand essence – "Big Transformations through Brave Actions" will drive the company’s core values – empowering people, being flexible, making it happen, openness and transparency and creating a positive impact.

Eighty per cent of the group’s current revenues come from Bharti Airtel (a leading mobile operator – India’s leading integrated telecom company with with over 80 million customers and voted as India’s most innovative company by The Wall Street Journal. In October 2008, GSM player Bharti Airtel outperformed all CDMA players (like Reliance Communications, Tata Teleservices, HFCL and Shyam Telecom) put together in terms of mobile revenues, net subscriber addition and revenue share. ). The group now wants to focus on its other retail, agri-business and financial services ventures where it has partnerships with other companies like Wal-Mart, Del Monte and Axa. The group is looking at revenues of $10 billion in around two years with non-telecom business generating at least 50 per cent of the revenues.

New Brand Logo

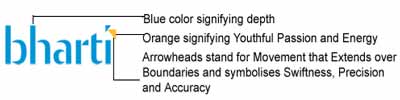

The group also introduced a new fresh and youthful brand logo which the company believes will depict its multi-dimensional character and its strategy to grow with new avenues.

Bharti’s New Brand Logo and its significance

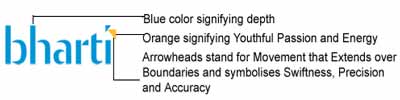

Bharti’s Old Brand Logo

The Bharti Group

The Bharti Enterprises group includes companies like Bharti Airtel (telecommunications services), Bharti Teletech (telecom & allied products company), Telecom Seychelles (telecom services in Seychelles), Bharti Telesoft (VAS products and services to telecom carriers), Bharti Del Monte India (fresh and processed fruits and vegetables), Bharti Retail (multiple consumer friendly format stores in India), Bharti AXA General Insurance, Bharti AXA Life Insurance, Bharti AXA Investment Managers (asset management company), Bharti Learning Systems (end-to-end learning and development solutions organisation), Jersey Airtel (mobile services in Jersey (Channel Islands)), Guernsey Airtel, Bharti Foundation, Bharti Realty (Real Estate Arm).

Supply Chain Management (SCM), in recent years, has received increased attention from both academicians and managers. Managing a supply chain implies the integrated management of a network of entities, that begins with the suppliers' suppliers and ends with the customers' customers, for the production of products and services to the end consumers. Supply chain case studies analyze how companies seek to achieve cost reductions or profit improvements and make the supply chain more competitive as whole.

Supply Chain Management (SCM), in recent years, has received increased attention from both academicians and managers. Managing a supply chain implies the integrated management of a network of entities, that begins with the suppliers' suppliers and ends with the customers' customers, for the production of products and services to the end consumers. Supply chain case studies analyze how companies seek to achieve cost reductions or profit improvements and make the supply chain more competitive as whole.